Payment Card for People with Dementia.

There’s a new payment card for people with dementia. Sibster is the first debit card in the UK designed especially to help people with dementia.

The launch of this payment card for people with dementia coincides with research showing nine in ten people with dementia struggle to manage day-to-day finances.

Nearly half of those asked admitted they find money difficulties cause them worry and stress. Sibstar has been created to combat this. It offers an innovative way for people with dementia to access and manage everyday spending. This also empowers them to remain financially independent longer in a safe, supported way.

Pre-loaded debit card.

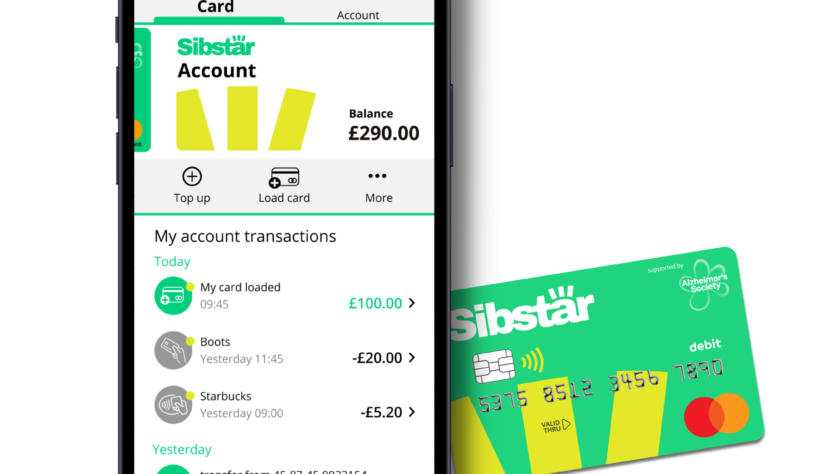

Sibstar is a pre-loaded Mastercard. How and where money is spent can be managed through the corresponding app. This is available on both iPhone and Android devices. Every element of Sibstar’s functionality can switched on or off instantly. This offers a flexible solution which can be changed as the individual’s needs alter.

What the Sibster app includes;

- Spend limits,

- ATM withdrawals,

- Online spending,

- The ability to switch the phone on or off,

- Instant card freeze,

- Auto top-up,

- Real-time notifications.

This will be a real bonus. There are currently around 900,000 people with dementia in the UK. Alarmingly, this is projected to rise to 1.6 million by 2040.

In addition to physical symptoms, many people with dementia lose their ability to deal with daily finances. As people become more confused vulnerability increases. Therefore individuals are more likely to be the victim of a scam. People with dementia are also more likely to misplace cash or cards. In addition, they may also give money away inappropriately. Some people over-buy items. Ultimately, these situations can result in their hard-earned savings dwindling.

Long-overdue help for people with dementia.

In recent years there have been improvements for people with dementia in the financial sector. It has been working to make services more accessible to people with the disease. These banking services however still don’t provide the necessary security and ease of management for people with dementia.

2/3 felt there wasn’t enough being done to help people with dementia manage their money safely. In the absence of a suitable solution, often the only choice for those living with dementia is to limit or remove access to their finances, which severely limits their independence and ability to enjoy everyday activities.

Who designed Sibster?

It’s these issues which Sibstar addresses head-on and is the brainchild of Jayne Sibley. In the UK 65 people with dementia & their families piloted the programme

“Sibstar will be a solution to maintaining Dad’s dignity whilst enabling the control we as a family need to help him. He frequently asked us to find a way to help him and I’ve been looking. I wish I had found Sibstar sooner” said one family member.

Financially Independent

Jayne Sibley, co-founder of Sibstar has both parents with dementia said, “As my Mum’s dementia progressed her ability to manage her everyday money declined. One of the hardest challenges we faced as a family was finding a way for Mum to remain financially independent whilst keeping her money safe. Mum needs access to her own money to live her life the way she wants. As a result, we developed Sibstar”.

Understandably, how we choose to spend our money is a big part of our identity. Therefore that shouldn’t have to change because you have dementia. We believe Sibstar provides a way for people to manage their money more safely. This reduces their financial vulnerability, helping them remain independent and living the life they choose.”

Alzheimer’s Society Involvement.

Colin Capper is the Associate Director of Evidence and Involvement at Alzheimer’s Society. He said: “Too many people living with dementia face barriers using financial services. This leaves them with a loss of independence and vulnerable to scams. The Alzheimer’s Society is working to make the sector more dementia-friendly, alongside raising awareness of the challenges involved.

The Alzheimer’s Society supported Sibstar with its Accelerator Programme. This funds innovations and inventions which change lives for people with dementia.”

The Divisional President of Mastercard UK (Kelly Devine) said “ We believe everyone should have access to financial services in a way that works for them. Innovations in technology are making it increasingly possible to build products for specific needs. Sibstars evidence of this. This is a much-needed solution. It is making financial independence a reality for people with dementia.”